Will the peak price of Bitcoin be broken?

Bitcoin's movement is cyclical. Although the price volatility is high, over the past 10 years, it has always returned and broken through its historical highs. There are several factors associated with it: media influence, miners' revenues, the versatility of the blockchain, the overall growth of cryptocurrency market capitalization, and updates within the network.

Each of the factors carries a certain value by which the price goes up:

● Miners' profits. The more labor-intensive the process of mining Bitcoin blocks, the higher the price per coin. Accordingly, the lower the miners' income from Bitcoin mining, the better it affects the final value of the asset;

● Media influence. The popularity of the crypto-industry has grown so much that some states recognize Bitcoin as an official means of payment today;

● The versatility of blockchain. The number and complexity of transactions also affect the cost. The lower the commission, the fewer confirmations the network requires for each transaction - the higher the price;

● Growth of currency market capitalization. Bitcoin is the first cryptocurrency by capitalization. Because of it, it is the most secure of the represented ones, which is why people buy it.

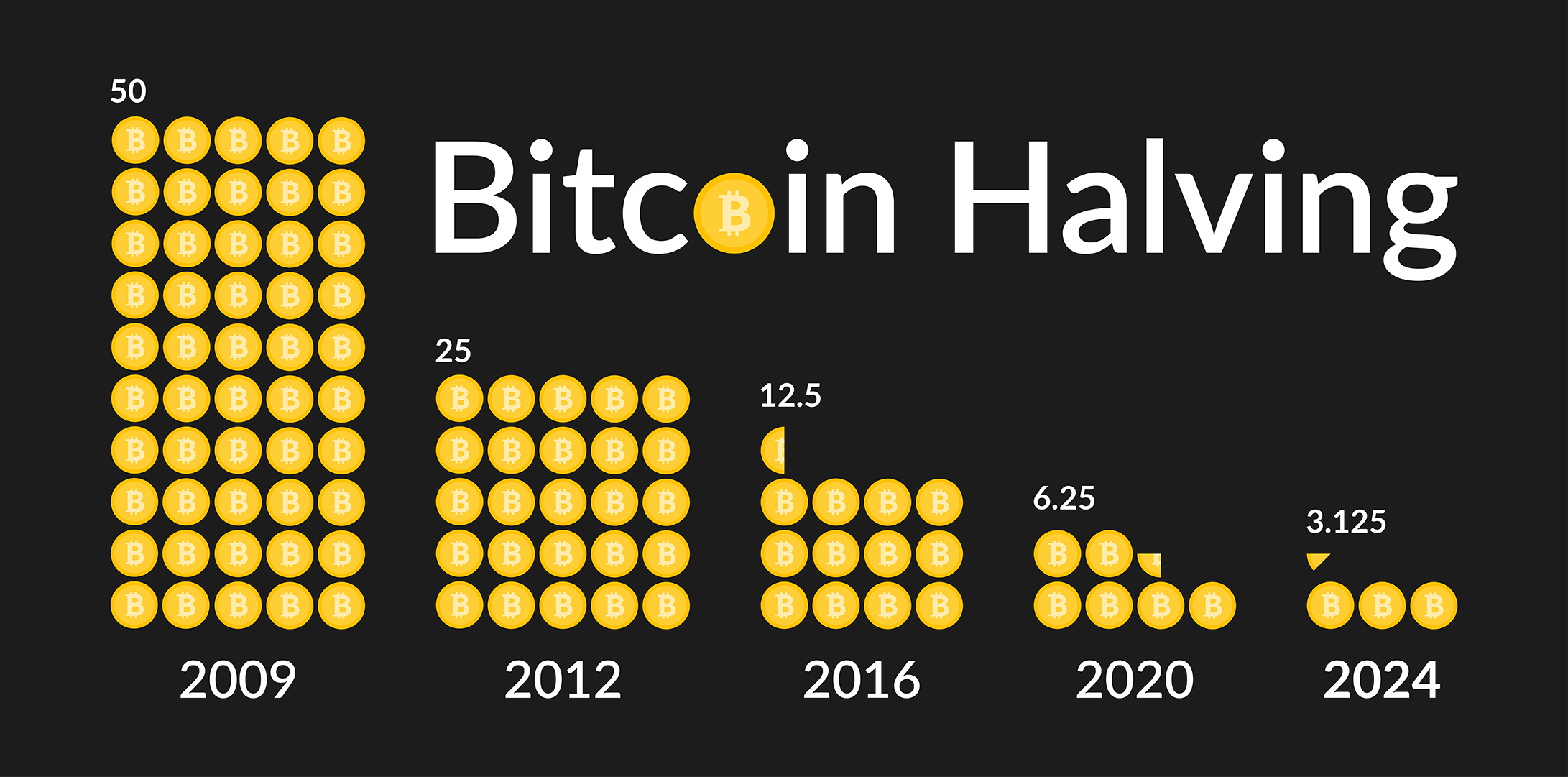

Blockchain updates also affect the price. A Bitcoin halving, for example, allows almost a hundred percent guarantee of earnings for both newcomers and large holders of the asset, due to a sharp, predictable rise in the price. The last halving was on May 11, 2020. From that time until now, the Maximum Price for Bitcoin has been beaten numerous times and peaked at $69020 per coin.

After halving, there is a year of active growth, when not only Bitcoin, but the entire cryptocurrency strengthens its positions. Then, the situation is legitimized. Experts consider that the maximum price for Bitcoin has not yet reached its peak, and in early 2022 may stop at $ 70-80 thousand per coin. There is another scenario, according to which the bull market cycle can be considered complete. In that case, the price for the asset will hold at the same level. However, the external news can also fluctuate the rate. For example, Tesla bought $1.5 billion worth of Bitcoins, after which the price of the asset rose 8% in a day, which on the scale of the current value could be $4,000.

How to exchange cryptocurrencies online

CryptoExchanger allows you to transfer the most popular cryptocurrencies at market prices with a fixed fee. Because of the automatic processing of requests, it is possible to exchange Bitcoin to Litecoin, Etherium to Tether, Dash to Zec, and other cryptocurrency pairs within 5-30 minutes. At the same time, the user can monitor the status of the transaction, as it is regularly updated.