Bitcoin mining is one of the most interesting questions in the crypto world. How many Bitcoins are mined per day determines the final price of the asset. The principle is simple: the more labor-intensive the process of building each block in the network, the higher the price. Accordingly, Bitcoin mining requires appropriately powerful equipment, which all miners don’t have.

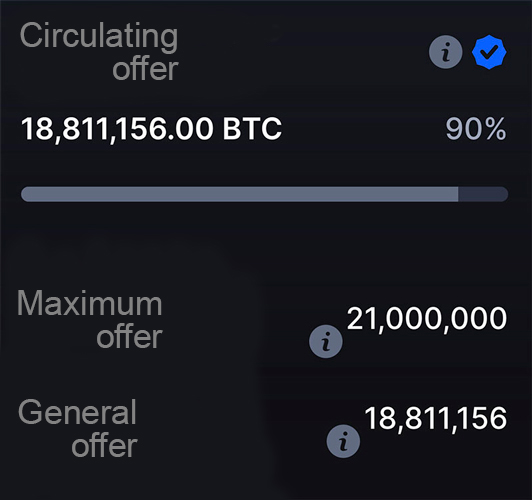

The total number of all Bitcoins is 21 million coins. In this case, at the moment, about 18.8 million coins are mined. The development trend shows that every year it is more and more difficult to mine Bitcoin. So, despite the numerical limit of coins, if the current mining speeds continue, all Bitcoins will be mined only by the year 2140. This prediction is taken into account the anticipated growth of the asset, as well as improvements in mining equipment.

Bitcoin influencing factors and daily Bitcoin mining

To calculate how many Bitcoins are mined per day, you need to divide the annual mining by 365 days. From 2020 to 2021, the amount of mined Bitcoins grew from 18.6 million coins to 18.8 million. So, 200 thousand Bitcoins were mined per year, which equals 548 BTC per day.

It is worth understanding that these calculations are only for 2020-2021. Further, this amount will decrease dramatically as conditions for mining become more complicated. And despite the technological development of equipment for mining BTC, the proportional increase in price is much higher than the computing power of mining farms. It means that every year, the number of coins mined per day will decrease.

These calculations can be made using the following formula: divide the number of Bitcoins remaining by the estimated time at which the last Bitcoin will be mined. So, we need to divide 2.2 million coins by 118 (years). The arithmetic average annual number is 18.6 thousand BTC, which is 51 bitcoins per day. This number is taken from the calculation of average numbers based on the total number of coins. So for 2022, the estimated daily mining will be a little less than the current value ≈of 530 BTC per day. It is worth understanding that the higher the asset price, the more labor-intensive it is to mine each block in the network. So, as the value increases, the rate of BTC mining will decrease asymmetrically.

Online cryptocurrency exchange

To make transfers, you need to have a quality online cryptocurrency exchanger. CryptoExchanger provides services you can make online exchanges of the most popular coins. For example, exchange Ethereum to Bitcoin, Bitcoin to Tether (USDT), Dash to Zec, etc. The peculiarity of the exchanger is a fully automated work due to the saved reserves at each transfer. So, carrying out any transaction takes 5-30 minutes. At the same time, the user can monitor the request status online.